Accounts Payable Workflow: A Complete Expert Guide for Modern Businesses

Managing finances efficiently is one of the biggest challenges for any organization, and at the center of this challenge lies the accounts payable workflow. Whether you’re running a small business or managing finance operations for a large enterprise, understanding and optimizing your accounts payable process can directly impact cash flow, vendor relationships, and overall financial health.

In today’s fast-paced business environment, manual and outdated AP processes simply don’t cut it anymore. Businesses need streamlined workflows that ensure accuracy, speed, and compliance. This article breaks down the accounts payable workflow step by step, explains why it matters, and shows how businesses can improve it using best practices and modern tools.

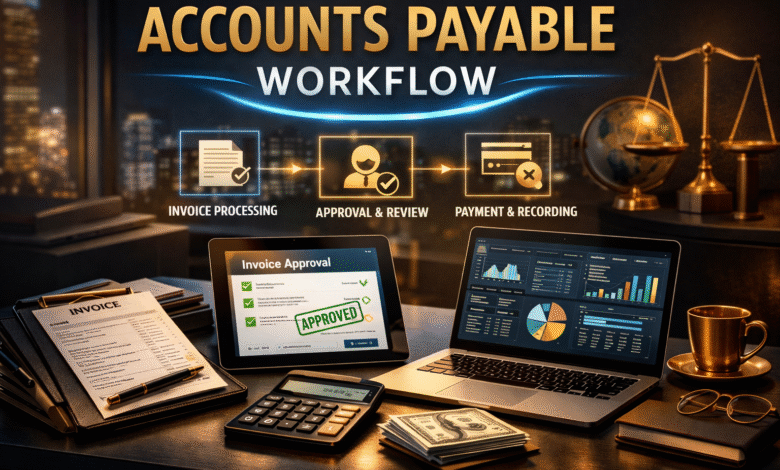

What Is an Accounts Payable Workflow?

The accounts payable workflow refers to the structured process a business follows to manage, approve, and pay vendor invoices. It starts when an invoice is received and ends when payment is successfully made and recorded in the accounting system. This workflow ensures that businesses pay the right amount, to the right vendor, at the right time.

At its core, an accounts payable workflow is about control and visibility. It helps organizations avoid duplicate payments, catch billing errors, and maintain accurate financial records. Without a defined workflow, invoices can easily get lost, approvals can be delayed, and late payments can damage supplier relationships.

Modern AP workflows go beyond simple invoice handling. They integrate with accounting software, enforce approval hierarchies, and provide real-time reporting. This evolution has turned accounts payable from a back-office function into a strategic part of financial operations.

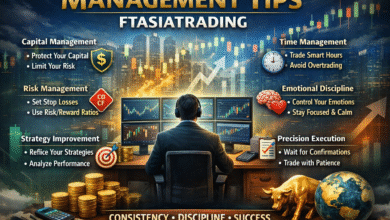

Key Stages of the Accounts Payable Workflow

The accounts payable workflow consists of several interconnected stages that work together to ensure smooth invoice processing. Each stage plays a critical role in maintaining accuracy and efficiency throughout the process.

The first stage is invoice receipt, where invoices are collected from vendors. These invoices may arrive via email, physical mail, or electronic data interchange (EDI). Centralizing invoice intake is essential to avoid missed or duplicated invoices and to create a single source of truth.

Next comes invoice verification and approval. During this stage, invoice details are matched against purchase orders and delivery receipts to confirm accuracy. Once verified, the invoice moves through an approval chain based on company policies. This step ensures accountability and prevents unauthorized payments before the final stage of payment execution and recordkeeping.

Importance of an Efficient Accounts Payable Workflow

An efficient accounts payable workflow directly impacts a company’s financial stability. When invoices are processed accurately and on time, businesses can better manage cash flow and avoid unnecessary late fees or penalties. Timely payments also help build trust and long-term relationships with suppliers.

Another major benefit is improved visibility into financial obligations. A well-structured workflow provides real-time insights into outstanding liabilities, upcoming payments, and spending patterns. This visibility allows finance teams to make informed decisions and forecast cash requirements more accurately.

Additionally, a strong accounts payable workflow reduces operational risk. Built-in checks and balances help prevent fraud, duplicate payments, and human errors. Over time, this leads to cleaner audits, better compliance, and increased confidence from stakeholders.

Common Challenges in Traditional Accounts Payable Workflows

Despite its importance, many businesses still struggle with outdated or inefficient accounts payable workflows. One of the most common challenges is manual data entry, which is time-consuming and prone to errors. A single typo can lead to incorrect payments or reconciliation issues.

Another challenge is lack of standardization. When invoices are processed differently across departments or locations, it becomes difficult to maintain consistency and control. Approval delays are also common, especially when workflows rely on physical documents or email chains that slow down decision-making.

Finally, limited visibility can create major problems. Without clear tracking, finance teams may not know where an invoice is in the workflow, leading to late payments and frustrated vendors. These challenges highlight the need for modern, automated solutions.

Automation and Technology in the Accounts Payable Workflow

Automation has completely transformed the accounts payable workflow. With AP automation tools, businesses can capture invoice data automatically using optical character recognition (OCR), eliminating the need for manual entry and reducing errors.

Automated workflows also streamline approvals. Invoices are routed digitally to the appropriate approvers based on predefined rules, ensuring faster decision-making. Notifications and reminders help prevent bottlenecks and keep the process moving smoothly.

Beyond efficiency, automation provides valuable analytics. Businesses can track processing times, identify recurring issues, and measure performance across the AP function. This data-driven approach allows organizations to continuously refine and optimize their accounts payable workflow.

Best Practices for Optimizing Accounts Payable Workflow

Optimizing your accounts payable workflow starts with standardization. Clearly defining each step, from invoice intake to payment, ensures consistency and accountability across the organization. Documented procedures also make training new team members easier and more effective.

Another best practice is implementing a centralized invoice management system. By consolidating all invoices into one platform, businesses gain better visibility and control. This centralization reduces the risk of lost invoices and enables faster processing.

Regular reviews and audits are also essential. By analyzing workflow performance and identifying bottlenecks, finance teams can make targeted improvements. Combining these practices with automation tools creates a robust and future-ready accounts payable workflow.

Accounts Payable Workflow and Vendor Relationships

The accounts payable workflow plays a crucial role in shaping vendor relationships. Consistent and timely payments demonstrate professionalism and reliability, which can lead to better terms, discounts, and long-term partnerships.

When vendors know what to expect from your payment process, communication improves. Clear workflows reduce disputes over invoices and payments, saving time for both parties. This transparency builds trust and minimizes friction.

An optimized accounts payable workflow also allows businesses to take advantage of early payment discounts or negotiate favorable payment terms. Over time, these benefits contribute to cost savings and stronger supplier networks.

The Future of Accounts Payable Workflow

The future of the accounts payable workflow is increasingly digital and intelligent. Artificial intelligence and machine learning are being used to predict invoice issues, recommend approval paths, and detect anomalies before they become problems.

Cloud-based AP platforms are also becoming the norm, enabling remote access, scalability, and seamless integration with other financial systems. These platforms provide real-time visibility and support global operations more effectively.

As businesses continue to evolve, the accounts payable workflow will shift from a transactional function to a strategic one. Organizations that invest in modern AP workflows today will be better positioned for growth, resilience, and financial success in the future.

Final Thoughts on Accounts Payable Workflow

A well-designed accounts payable workflow is more than just a process—it’s a foundation for financial efficiency and control. By understanding its stages, addressing common challenges, and embracing automation, businesses can transform their AP operations.

From improving cash flow management to strengthening vendor relationships, the benefits of an optimized accounts payable workflow are far-reaching. It reduces errors, saves time, and provides the financial visibility every business needs.

In a competitive business landscape, mastering the accounts payable workflow is no longer optional. It’s a strategic advantage that empowers organizations to operate smarter, faster, and with greater confidence.