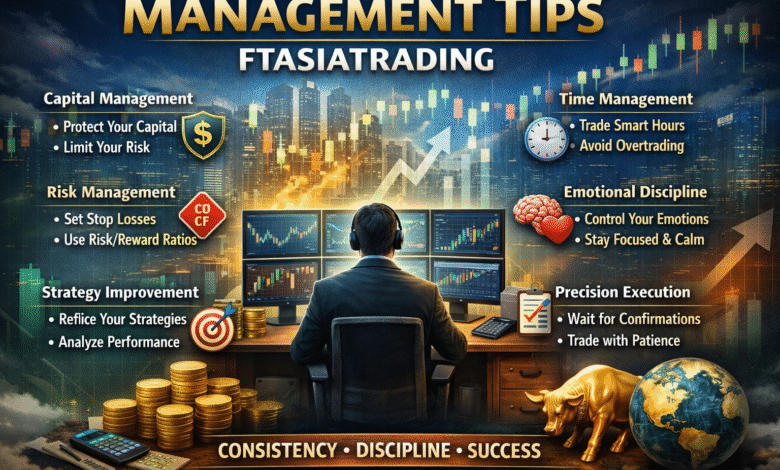

Management Tips FTAsiaTrading: Expert Strategies for Smarter, Sustainable Trading Success

In today’s fast-moving financial markets, success in trading isn’t just about spotting the right opportunity at the right time. Management Tips FTAsiaTrading It’s about management—of risk, capital, emotions, time, and strategy. That’s where management tips FTAsiaTrading come into focus. Traders who follow FTAsiaTrading-style principles understand that long-term consistency beats short-term luck every single time.

Whether you’re new to trading or already active in Asian and global markets, mastering management techniques can completely change your results. This article breaks down expert-level yet practical management tips inspired by FTAsiaTrading philosophies, written casually but grounded in real trading experience. If you want structure, discipline, and clarity in your trading journey, you’re in the right place.

Understanding the FTAsiaTrading Management Mindset

At the core of Management Tips FTAsiaTrading is a mindset that prioritizes control over chaos. Many traders fail not because they lack market knowledge, but because they lack a clear management framework. FTAsiaTrading-style management focuses on creating systems that remove emotional decision-making and replace it with calculated, repeatable actions.

One of the most important ideas here is accepting that losses are part of the process. Management Tips FTAsiaTrading Instead of trying to win every trade, FTAsiaTrading management principles teach traders to manage losses so they remain small and manageable. This approach shifts your focus from individual trades to overall performance across weeks, months, and years.

Another key aspect of this mindset is patience. Management Tips FTAsiaTrading Markets don’t always offer good opportunities, and forcing trades is one of the fastest ways to drain capital. FTAsiaTrading emphasizes waiting for high-probability setups and managing capital wisely until those moments appear. This disciplined waiting is a management skill many traders underestimate.

Capital Management: The Foundation of FTAsiaTrading Success

Capital management is arguably the most critical pillar within management tips FTAsiaTrading. Without proper capital allocation, even the best strategies eventually fail. Management Tips FTAsiaTrading Successful traders treat their capital like business inventory—protected, measured, and deployed with purpose.

A widely followed FTAsiaTrading principle is never risking too much on a single trade. Most experienced traders limit risk to a small percentage of their total account, often between 1% and 2%. This ensures that even a series of losing trades won’t wipe out your account or damage your confidence beyond repair.

Capital management also includes knowing when not to trade. Management Tips FTAsiaTrading During periods of high volatility, unclear market structure, or emotional stress, stepping aside can be the smartest move. FTAsiaTrading management encourages traders to preserve capital during uncertain times so they’re ready when conditions improve.

Risk Management Strategies Every FTAsiaTrader Should Use

Risk management is where theory meets reality. Management Tips FTAsiaTrading You can have the best market analysis in the world, but without strong risk controls, one bad decision can erase weeks of progress. FTAsiaTrading management tips strongly emphasize predefined risk rules.

One essential practice is setting stop-loss levels before entering any trade. Management Tips FTAsiaTrading These stops aren’t random; they’re placed based on market structure, volatility, and technical levels. This removes emotional hesitation when the market moves against you and ensures discipline under pressure.

Another important risk management concept is risk-to-reward ratio. FTAsiaTrading encourages traders to seek setups where potential rewards clearly outweigh potential losses. Even if you win only half your trades, a favorable risk-to-reward ratio can still lead to long-term profitability.

Time Management and Market Focus in FTAsiaTrading

Time is an often-overlooked resource in trading. Many traders spend countless hours watching charts without a clear plan, leading to burnout and impulsive decisions. Management Tips FTAsiaTrading management tips stress the importance of structured time management.

Instead of monitoring markets all day, FTAsiaTrading-style traders define specific trading sessions and timeframes. They know which markets are most active and align their schedules accordingly. This reduces mental fatigue and improves decision quality.

Time management also means balancing trading with rest. Overtrading often comes from boredom or frustration rather than opportunity. FTAsiaTrading management principles remind traders that stepping away from screens can be just as productive as placing trades, especially when it helps maintain clarity and emotional balance.

Emotional Control: A Core FTAsiaTrading Management Skill

Emotional management is one of the hardest yet most important aspects of trading. Fear, greed, revenge trading, and overconfidence can all sabotage even the best strategies. FTAsiaTrading places strong emphasis on emotional discipline as a management skill.

One effective technique is journaling trades. By writing down your reasoning, emotions, and outcomes, you become more aware of behavioral patterns. FTAsiaTrading traders often use journals to identify emotional triggers and gradually eliminate destructive habits.

Another key practice is detaching self-worth from trade outcomes. Losses are data, not personal failures. FTAsiaTrading management encourages traders to view each trade as a probability event rather than a judgment on their intelligence or skill. This mindset reduces emotional swings and improves consistency.

Strategy Management and Continuous Improvement

A common mistake traders make is constantly switching strategies. FTAsiaTrading management tips advocate for mastering one or two proven strategies instead of chasing every new system. Consistency comes from repetition, not experimentation without structure.

Once a strategy is chosen, FTAsiaTrading-style management focuses on refining it through data. Traders regularly review performance metrics such as win rate, average risk-to-reward, and drawdowns. This analytical approach turns trading into a measurable process rather than a guessing game.

Continuous improvement also means adapting to market changes. FTAsiaTrading doesn’t promote rigid thinking. Instead, traders are encouraged to evolve their strategies while maintaining core management rules. Flexibility within discipline is what keeps traders relevant in changing markets.

Trade Execution Management: Precision Over Speed

Execution is where planning becomes profit or loss. FTAsiaTrading management tips emphasize precision and patience during trade execution. Entering trades too early, too late, or without confirmation can significantly reduce effectiveness.

Limit orders, predefined entry zones, and confirmation signals are often used to improve execution quality. FTAsiaTrading traders understand that missing a trade is better than entering a poor one. This mindset protects capital and confidence.

Managing open trades is just as important as entering them. FTAsiaTrading encourages traders to avoid micromanaging positions unless the plan requires it. Constantly adjusting trades out of fear often leads to premature exits and missed opportunities.

Building Long-Term Consistency with FTAsiaTrading Management

Long-term success in trading isn’t about one big win—it’s about thousands of small, well-managed decisions. FTAsiaTrading management tips are designed to build habits that support steady growth over time.

Consistency comes from following rules even when emotions say otherwise. This includes respecting risk limits, sticking to your trading plan, and accepting periods of drawdown as part of the journey. FTAsiaTrading philosophy views trading as a marathon, not a sprint.

Another long-term management principle is realistic goal setting. Instead of chasing unrealistic returns, FTAsiaTrading encourages achievable performance targets. This reduces pressure and helps traders stay disciplined, especially during challenging market conditions.

Final Thoughts: Why Management Tips FTAsiaTrading Truly Matter

When traders struggle, it’s rarely because they lack market knowledge. More often, it’s due to poor management—of capital, risk, emotions, and time. The management tips FTAsiaTrading approach provides a structured, professional framework that supports sustainable trading success.

By focusing on discipline over excitement, process over outcome, and consistency over speed, FTAsiaTrading-style management helps traders navigate markets with confidence and clarity. These principles aren’t shortcuts or guarantees, but they significantly increase the odds of long-term profitability.